Mortgage & Loan Guides

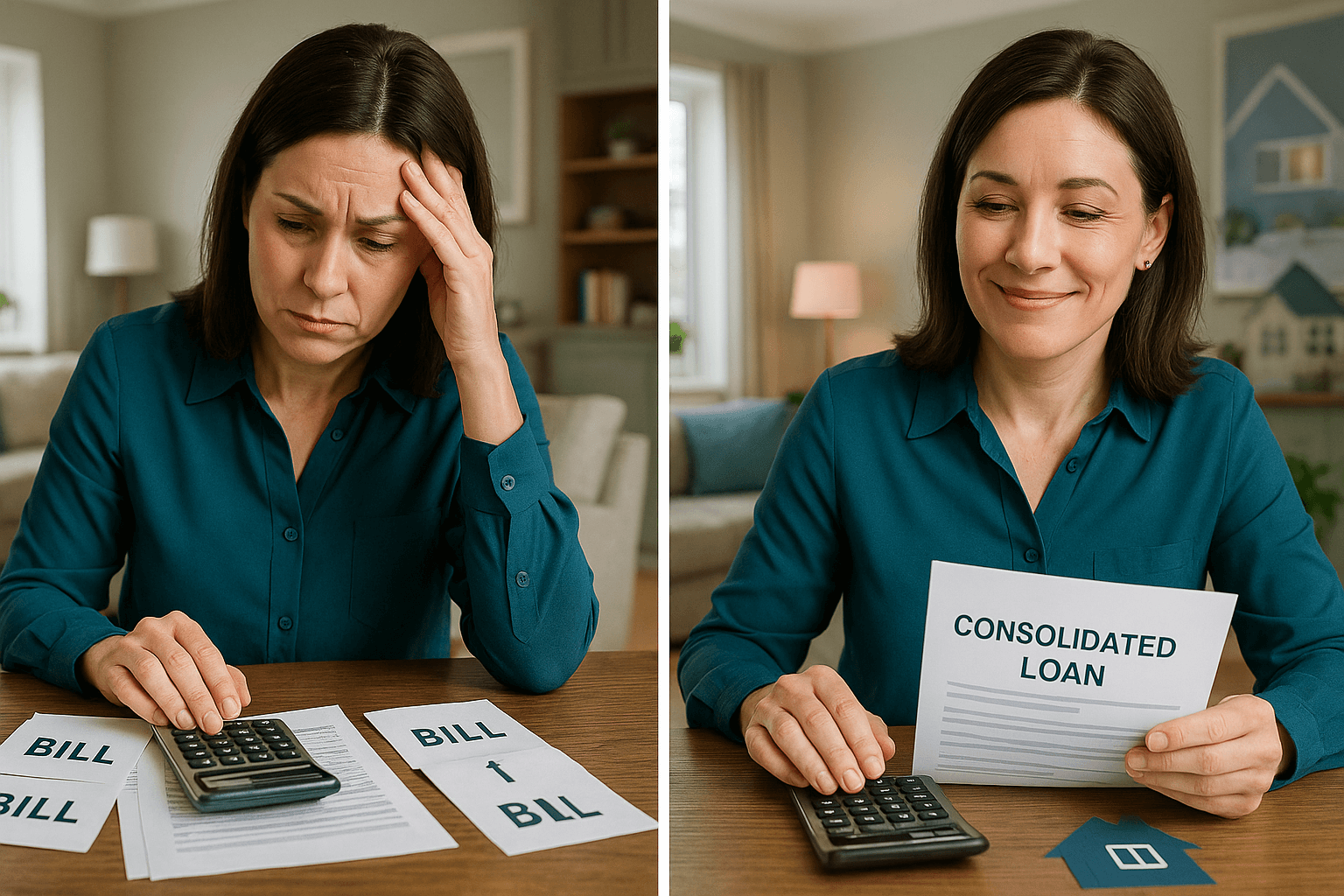

Remortgage to Consolidate Debt: Save £126 Monthly

Discover how a debt consolidation remortgage can empower you to regain financial control. This article follows a self-employed woman who successfully reduced her monthly outgoings by consolidating £36,401 of various debts into her mortgage, saving £126.86 each month. Learn about the potential benefits, including improved cash flow and the unlocking of equity for personal goals. If you're facing similar challenges, find out how expert mortgage advice can help tailor a solution specifically for you.

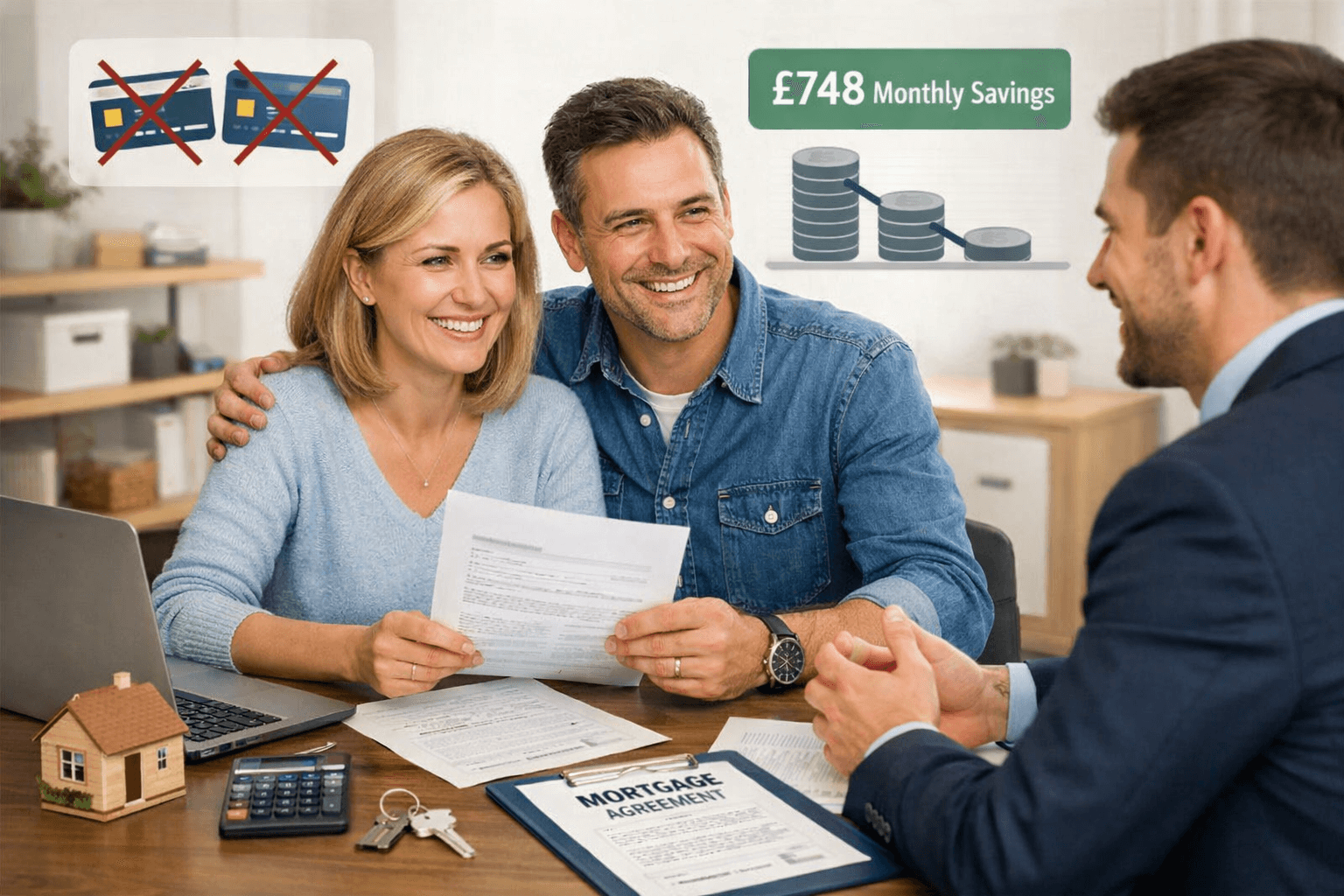

Debt Consolidation Mortgage: Save £748 Monthly in 2025

Discover how one UK couple transformed their financial situation by consolidating £34,466 of unsecured debts into a single mortgage, freeing up an impressive £748.18 in monthly disposable income. This strategic remortgage not only simplified their repayments but also provided the funds needed for essential home improvements. Learn the benefits of a debt consolidation mortgage and how it can help you regain control over your finances, ensuring a secure future amid rising living costs.

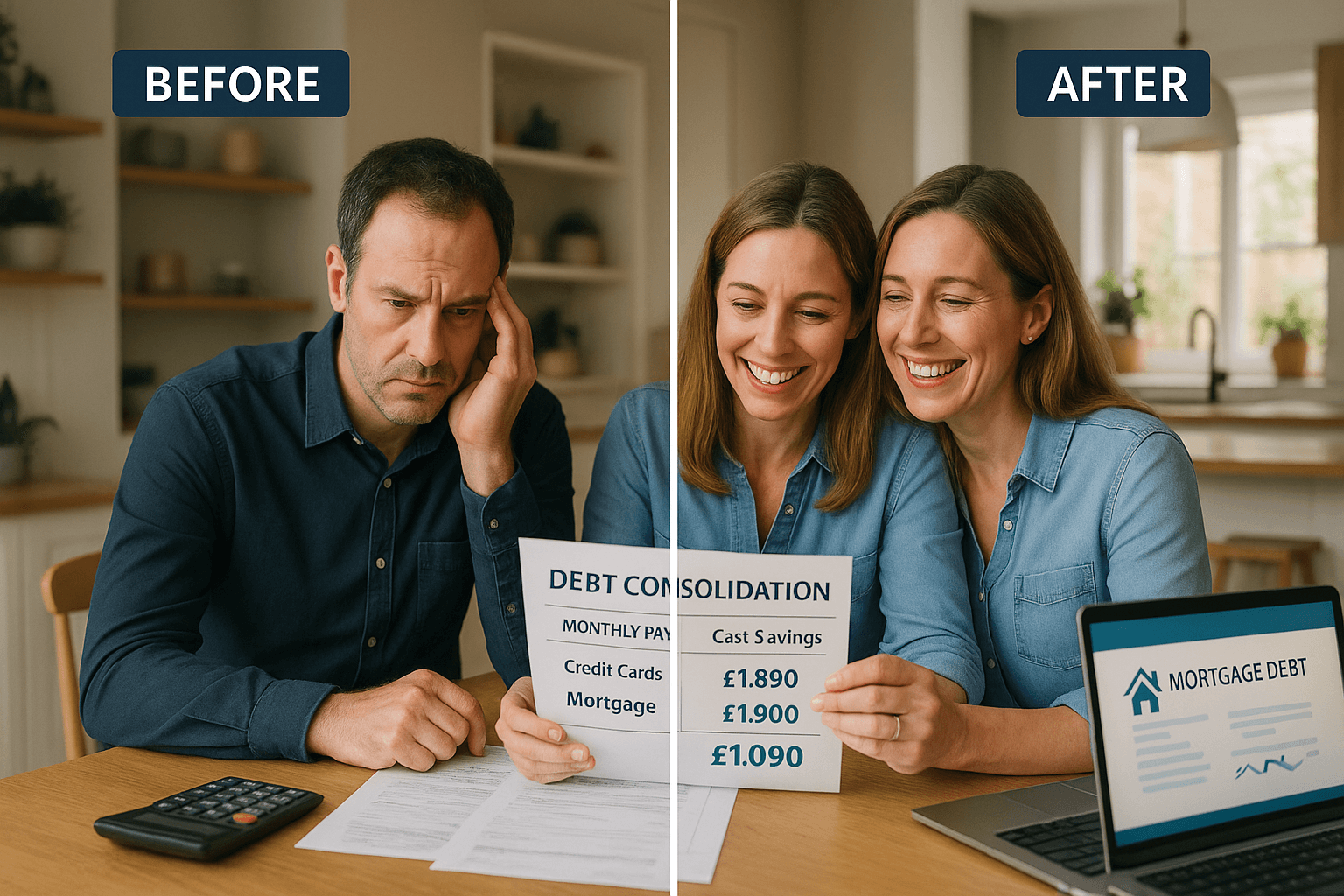

Remortgage to Clear Debt: £1,090 Monthly Savings Case

Discover how one self-employed couple tackled their overwhelming £62,000 credit card debt through a strategic remortgage for debt consolidation. Faced with high interest rates and fluctuating income, they transformed their financial situation by lowering monthly payments by over £1,090, therefore enhancing their cash flow and paving the way for savings. This case study illustrates the benefits of consolidating high-interest debts into a manageable mortgage, providing a pathway to financial stability and peace of mind. Explore your options for a debt-free future!

Remortgage to Clear Debt: Save £153 Monthly – NatWest

Explore how a couple in the South East of England successfully consolidated their debt through a remortgage, saving £153 a month. Faced with rising mortgage payments, they opted for a strategic remortgage with NatWest at a competitive rate, combining their existing mortgage and a secured loan. This decision not only provided immediate financial relief but also improved their cash flow, allowing for greater disposable income. Discover the benefits, long-term considerations, and how a debt consolidation mortgage might work for you.

Debt Consolidation Remortgage Case Study: £652 Monthly Saved

Discover how a debt consolidation remortgage enabled a Midlands couple to regain financial control by streamlining their high-interest credit card debts. By consolidating £5,270 of debt into a manageable mortgage, they reduced their monthly expenses, freeing up £652.10 for quicker repayment of their remaining card. This strategic move not only provided immediate financial relief but also paved the way for a sustainable long-term financial plan. Learn how this solution can help you tackle debt effectively.

Debt Consolidation Mortgage for Retirees – Case Study 2025

Discover how one retiree transformed her financial situation through a tailored debt consolidation mortgage. Faced with over £20,000 in unsecured debt, she sought a solution to alleviate monthly pressures while supporting her son. By opting for a retirement interest-only mortgage, she successfully consolidated her debts, released equity to gift £52,500, and improved her cash flow by £760 monthly. This strategic approach not only enhanced her financial independence but also provided peace of mind, allowing her to enjoy a more secure retirement.

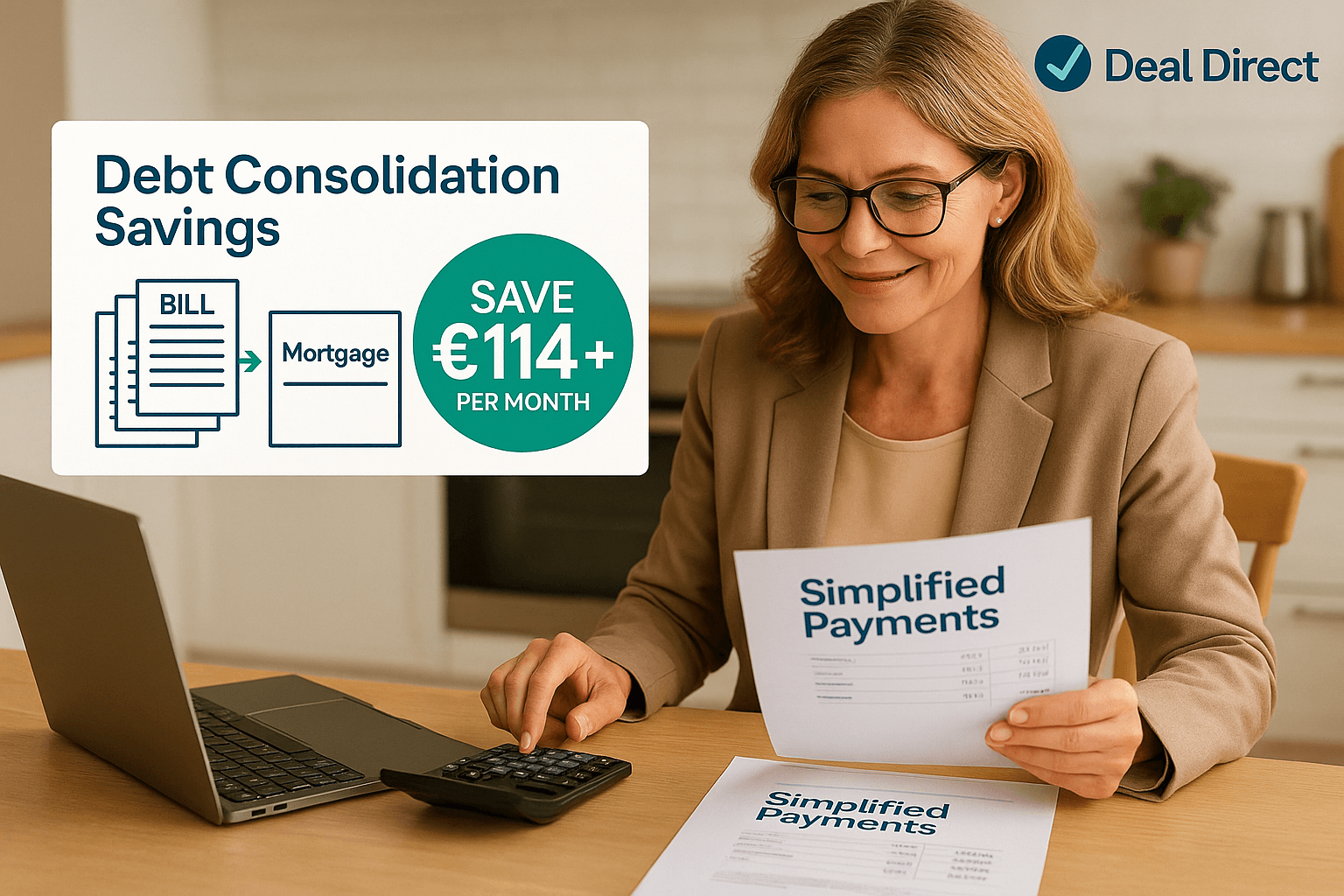

Deal Direct Debt Consolidation: Save £114+ Monthly 2025

Struggling with multiple high-interest loans, a UK homeowner in her 40s found relief through a debt consolidation remortgage. By integrating £9,705 of unsecured debt into her mortgage, she simplified her finances, reducing monthly payments by £114.36 and increasing her disposable income. This strategic move not only eased her financial burden but also enabled her to start building savings for unexpected expenses. Explore how remortgaging can transform your financial health and provide greater peace of mind.

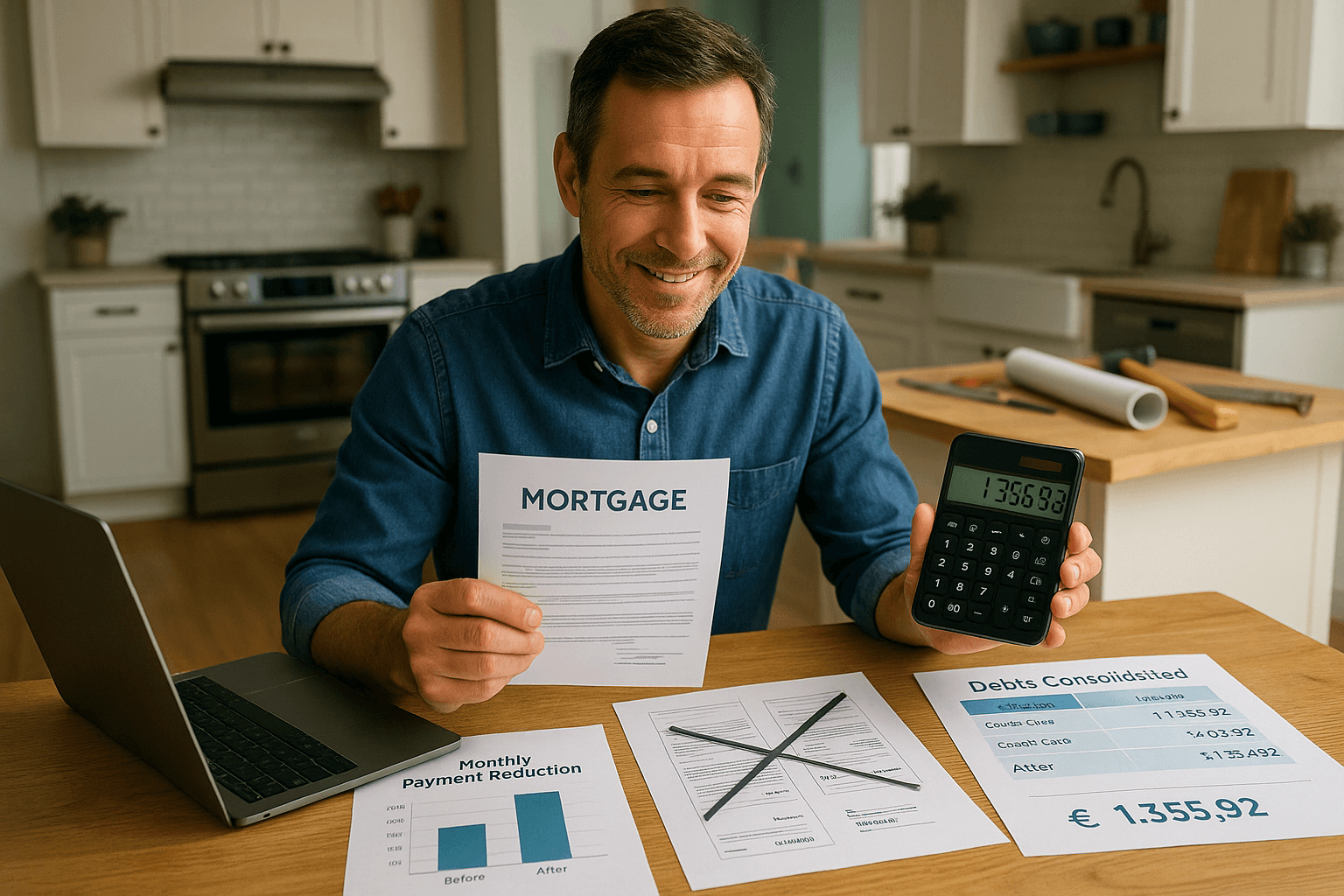

Debt Consolidation Mortgage Case Study 2025 – Save £1355/Month

Discover how a South of England homeowner transformed financial chaos into control by using a debt consolidation mortgage. After a significant property renovation, rising debts threatened their cash flow. Learn how consolidating high-interest debts into a single mortgage not only relieved financial stress but also enhanced monthly disposable income by over £1,350. With wisdom and timely actions, they leveraged home equity to create a simpler, more manageable repayment strategy. This case illustrates the power of debt consolidation for those juggling financial commitments.

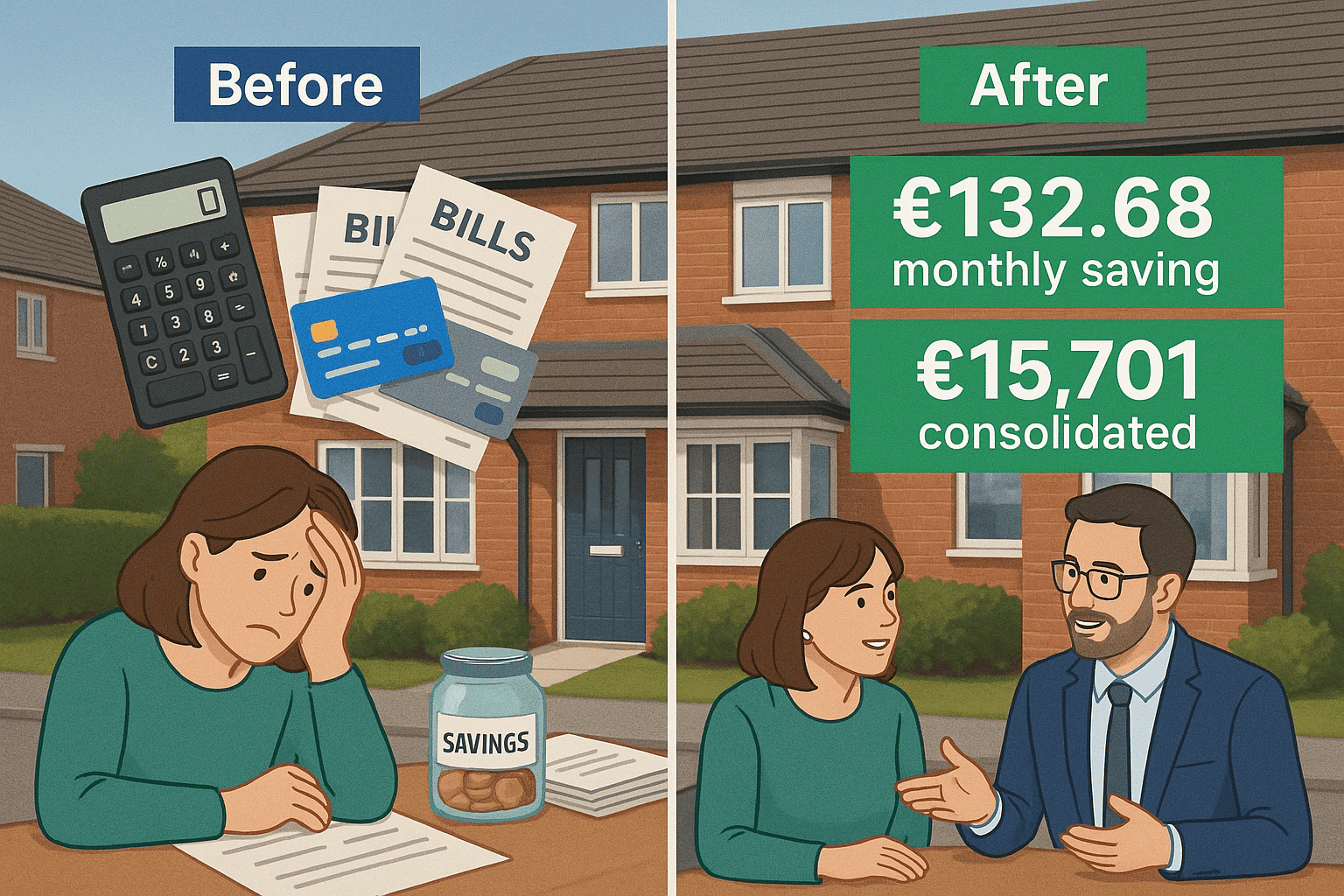

Debt Consolidation Mortgage Case Study – £132 Monthly Saving

Facing overwhelming financial strain, one homeowner turned to a debt consolidation mortgage to manage £15,701 in high-interest debt. This solution simplified repayments, enhancing monthly disposable income by £132.68 and alleviating stress. Although it extended repayment over time, the benefits of streamlined finances and improved cash flow were transformative, allowing the customer to focus on long-term savings. Discover how consolidating debt can offer relief and stability, paving the way for a brighter financial future.

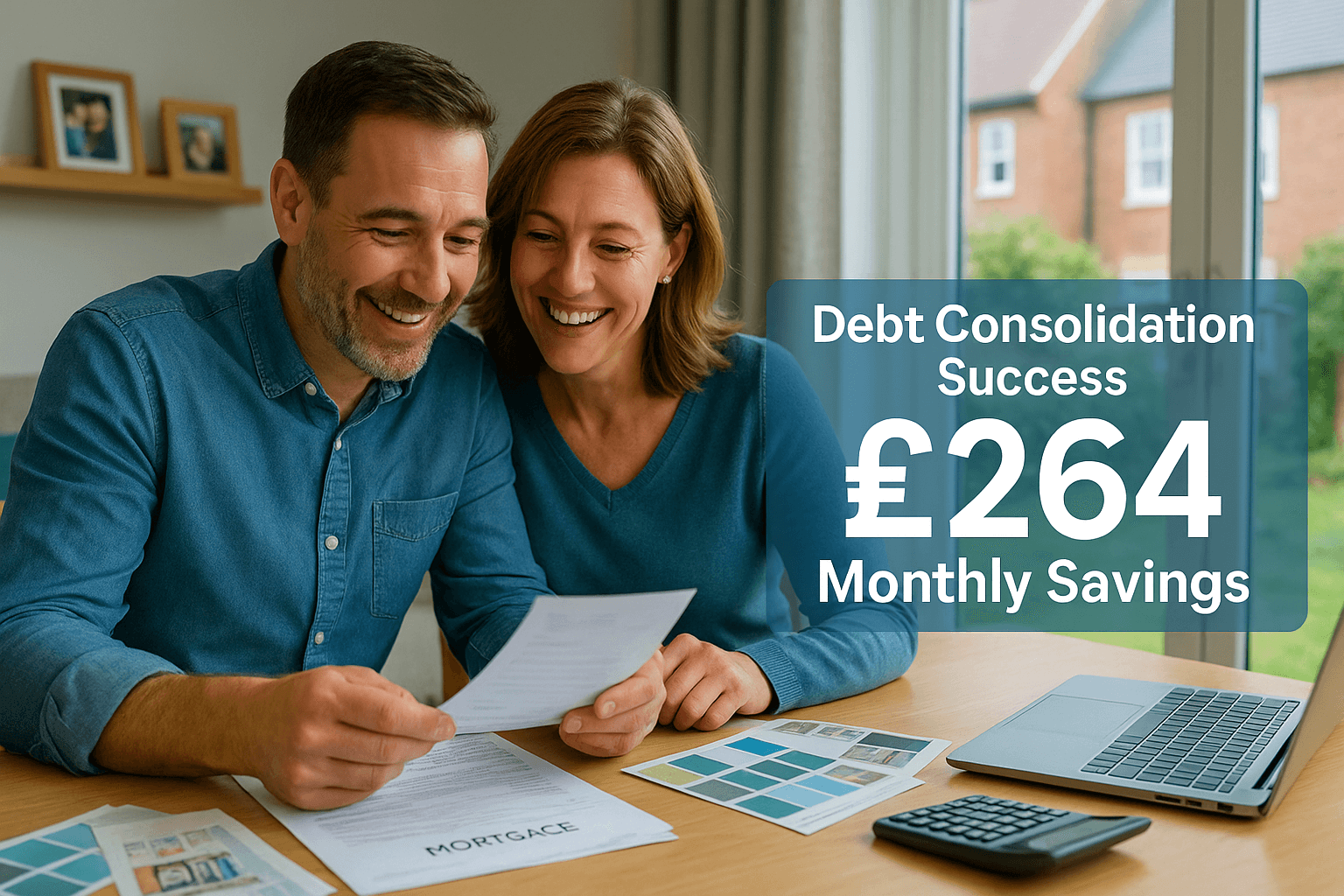

Debt Consolidation Mortgage Case Study: Save £264 Monthly

Facing rising mortgage costs and existing debts, a UK couple in their 40s successfully opted for a debt consolidation remortgage. By merging £14,973 of obligations into their mortgage, they saved £264.88 monthly, enabling necessary home improvements while preserving their lifestyle. This strategic decision, while incurring higher long-term costs, provided them with the financial flexibility needed to enjoy life without sacrificing comfort. Discover how a debt consolidation mortgage could be the solution for you.

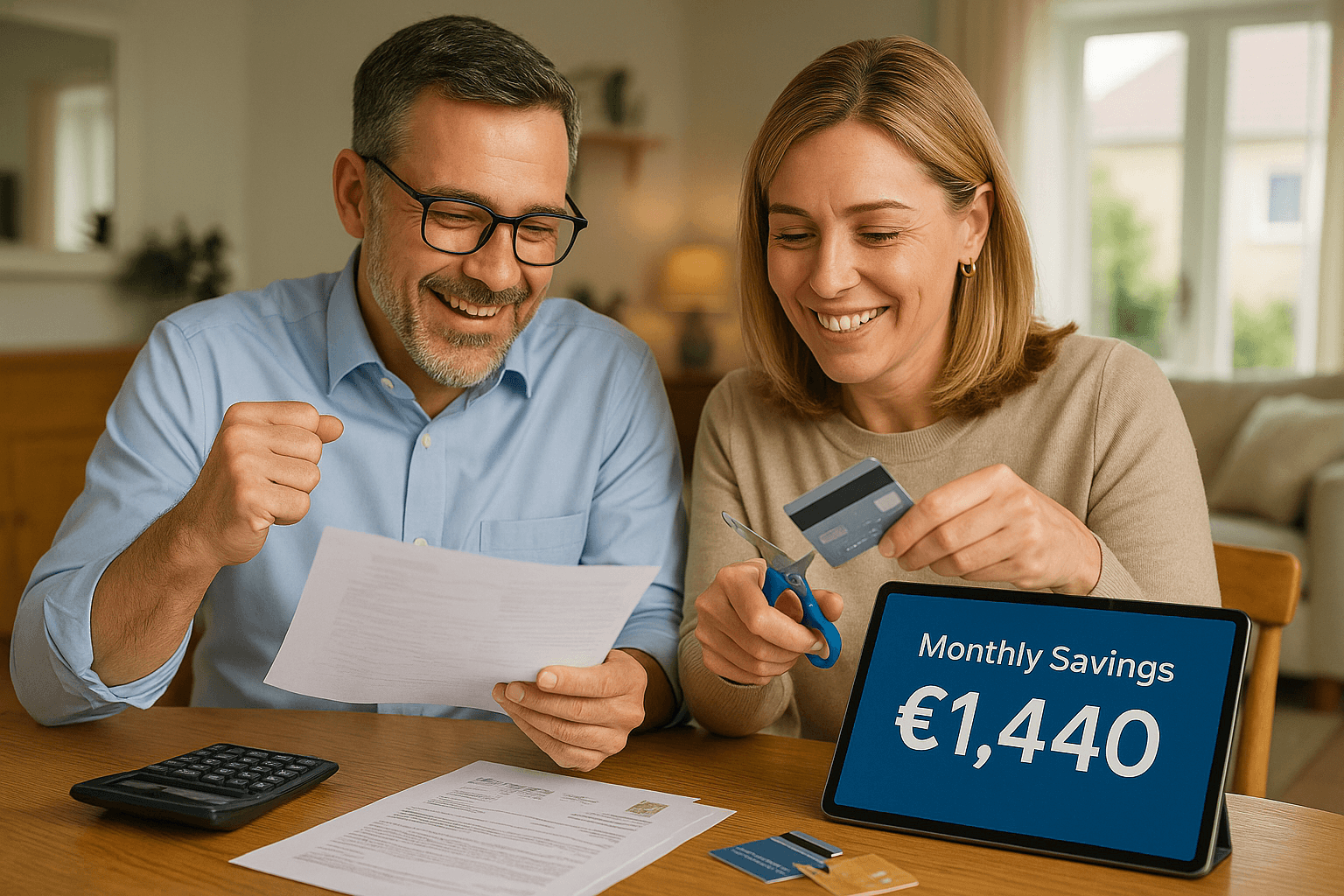

Debt Consolidation Remortgage Saves £1,440 Monthly

Discover how a debt consolidation remortgage transformed a professional couple's finances by freeing up over £1,440 in monthly disposable income. Faced with high-interest credit card debts and rising mortgage costs, this strategic move not only simplified their payments but also alleviated financial stress. Learn about the benefits of consolidating debts into your mortgage and how it can provide the breathing space needed to focus on saving for the future. Explore options for regaining control over your finances today!

Debt Consolidation Remortgage Case Study 2024 – £1085 Saved

Discover how a debt consolidation remortgage transformed a woman's financial situation, significantly reducing her monthly stress and boosting her disposable income by approximately £1,085.22. This strategic move streamlined multiple high-interest debts into one manageable mortgage payment, providing not only immediate relief but also a path towards improved credit stability. Learn about the benefits of consolidating your debts and regain control of your finances today!