Mortgage & Loan Guides

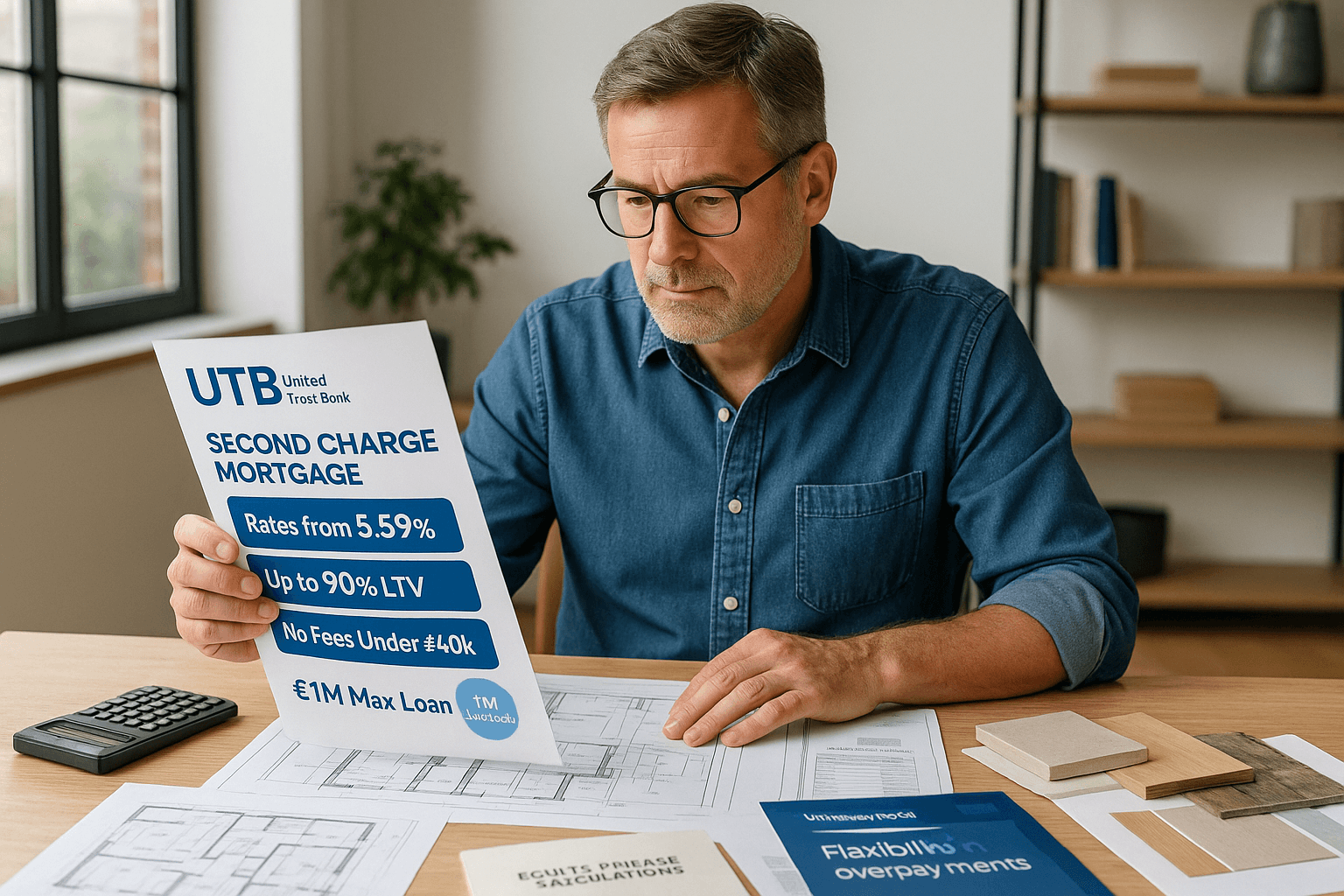

UTB Second Charge Mortgages: Rates Cut to 5.59% September

With rate cuts of up to 84 basis points, this update offers UK homeowners and property investors new...

Clydesdale Bank Rate Rises September 2025: Apply by Sept 14

These adjustments will impact residential, buy-to-let, and...

Principality Building Society Rate Rises: JBSP September 2025

These adjustments affect both new residential borrowers and...

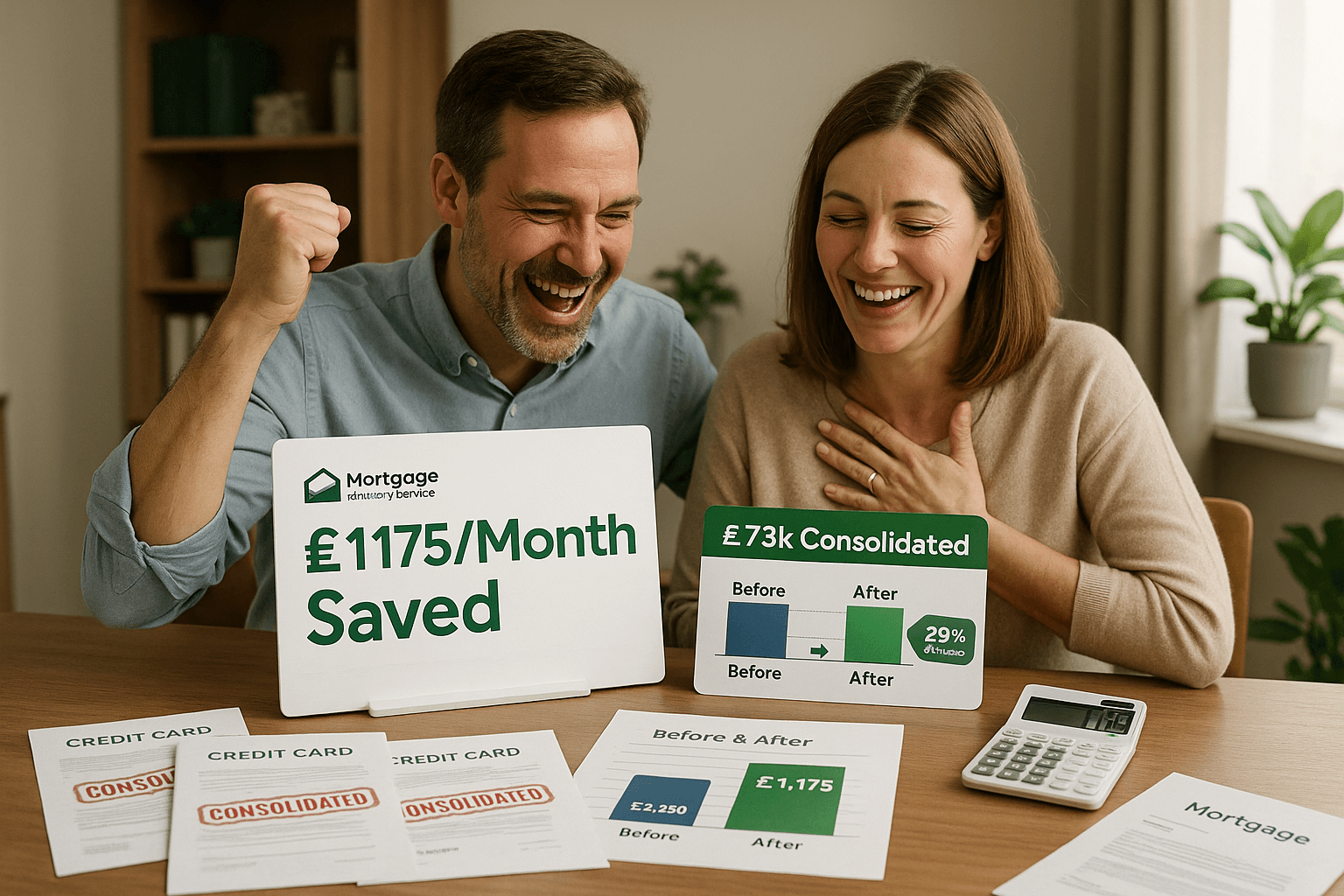

Debt Consolidation Remortgage: £1175/Month Saved Case Study

Challenges Faced: The couple was juggling numerous unsecured and...

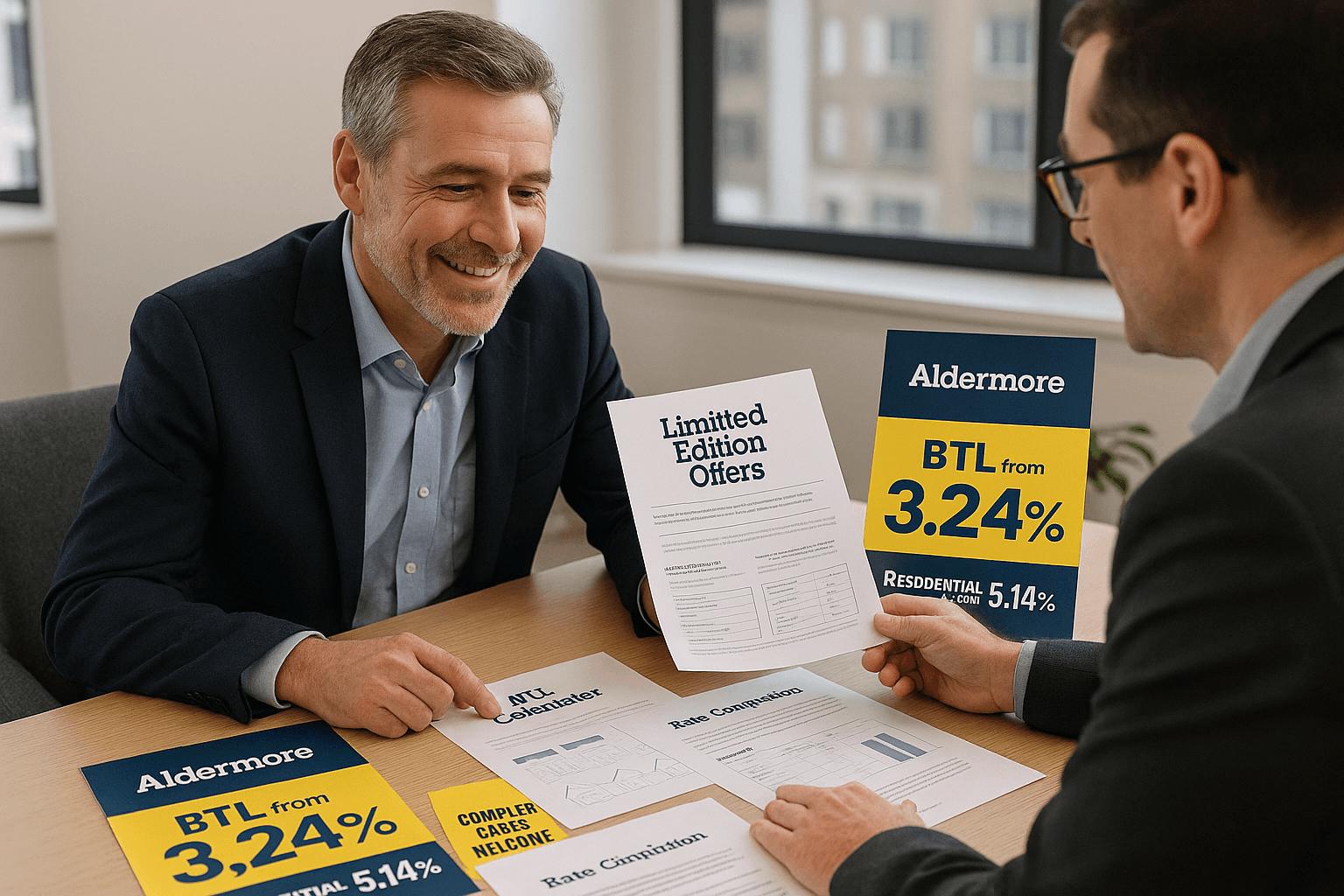

Aldermore Cuts BTL Rates to 3.24%: September 2025 Update

Latest Rate Reductions from Aldermore: What UK Borrowers Need to Know. These changes impact buy...

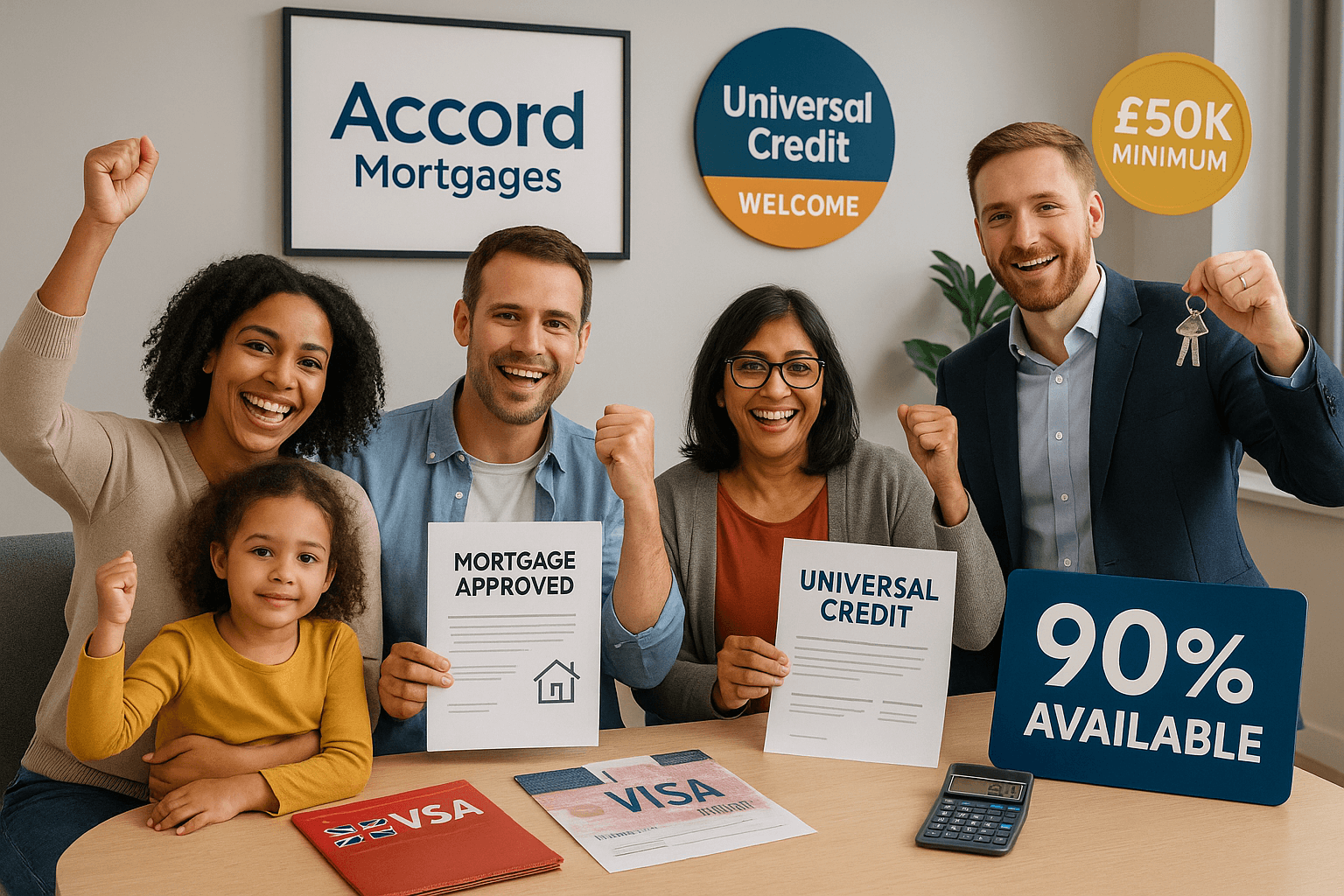

Accord Mortgages: 90% LTV Foreign Nationals + Universal Credit

As of September 2025, the lender now allows up to 90% loan-to-value...

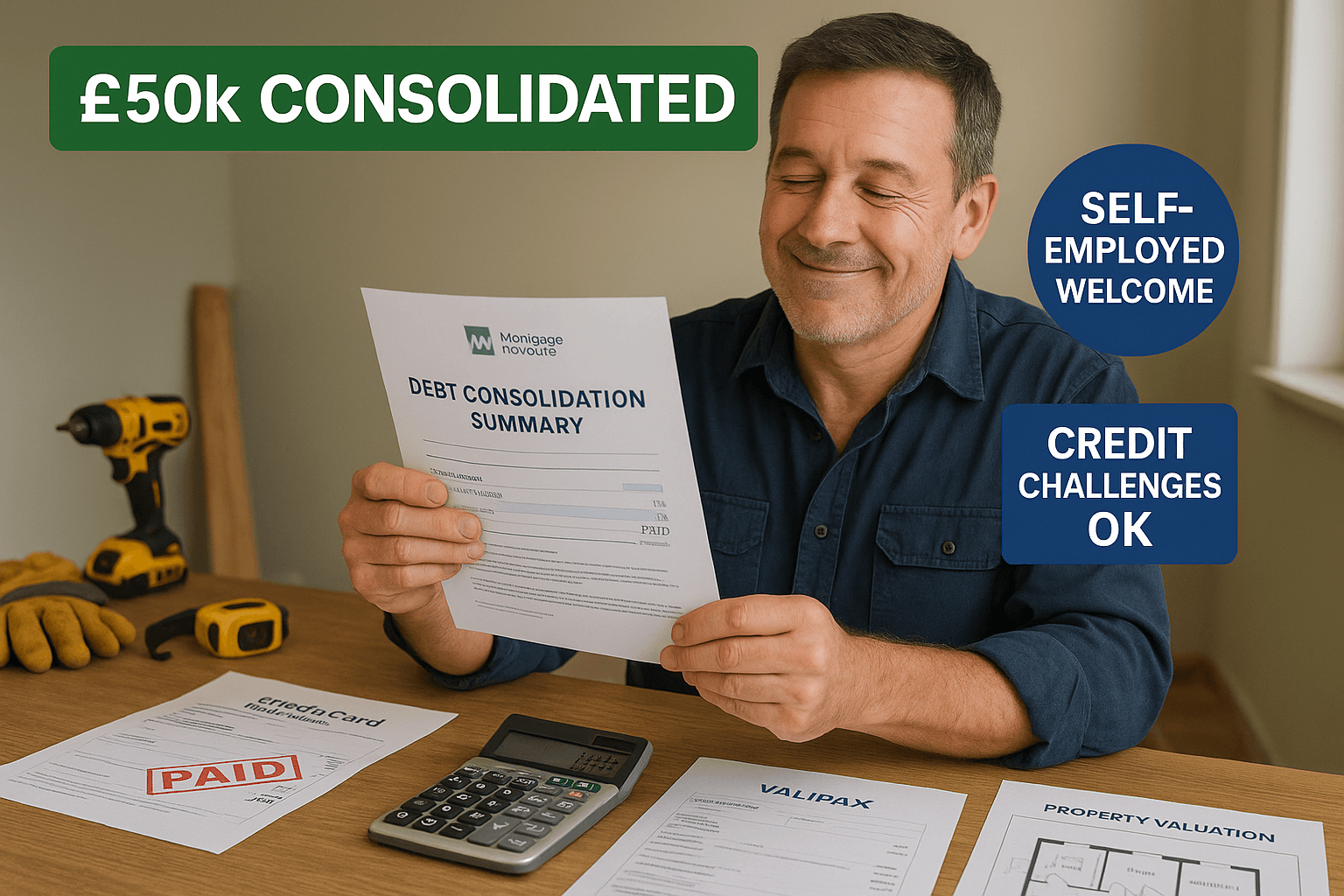

Debt Consolidation Mortgage: Self-Employed £50k Case Study

Customer Challenges: Managing Multiple Debts and Improving Cash Flow. This customer faced several...

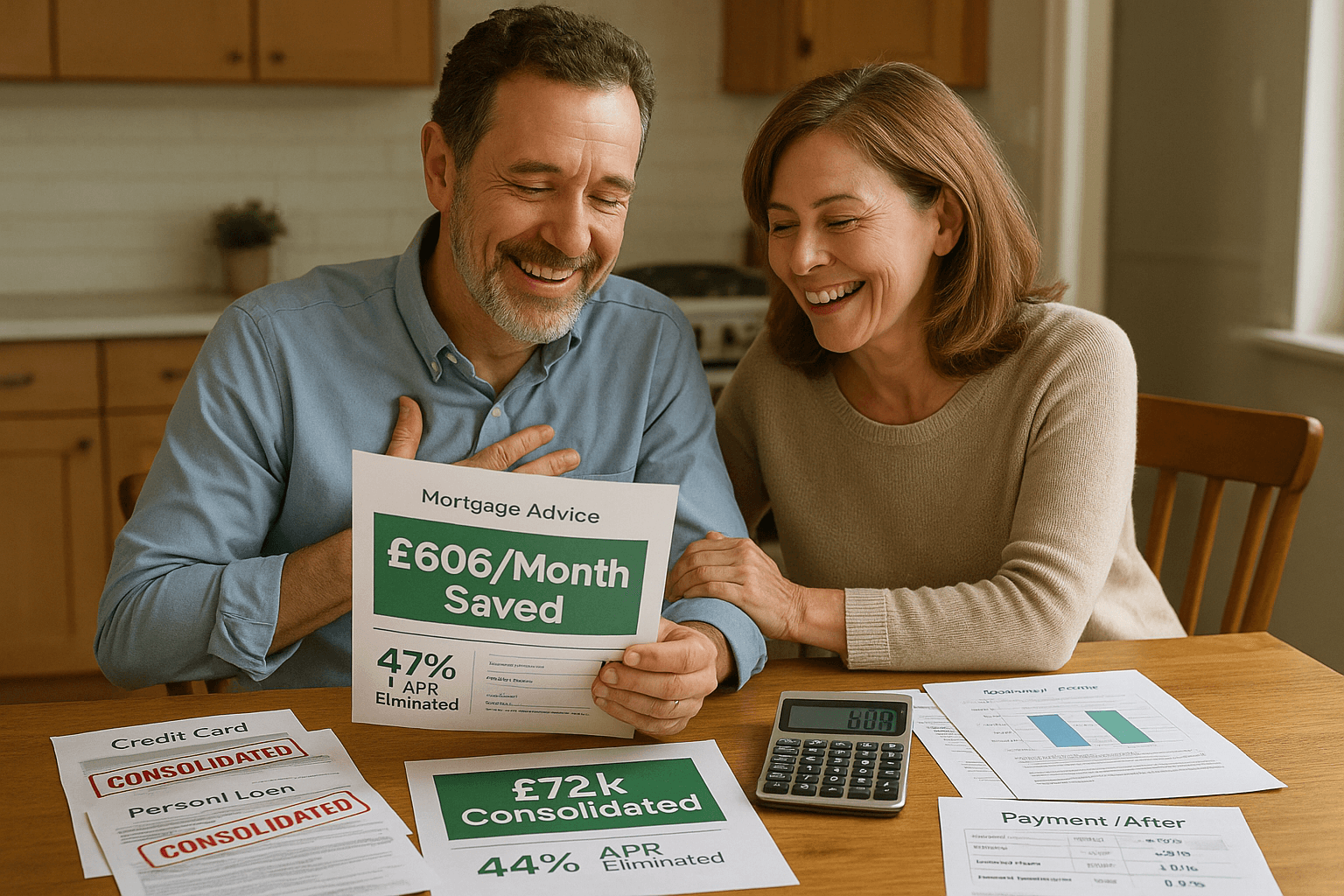

Debt Consolidation Mortgage: Couple Saves £600+ Monthly

With high-interest debts and an impending higher mortgage rate, they were seeking a way to maintain...

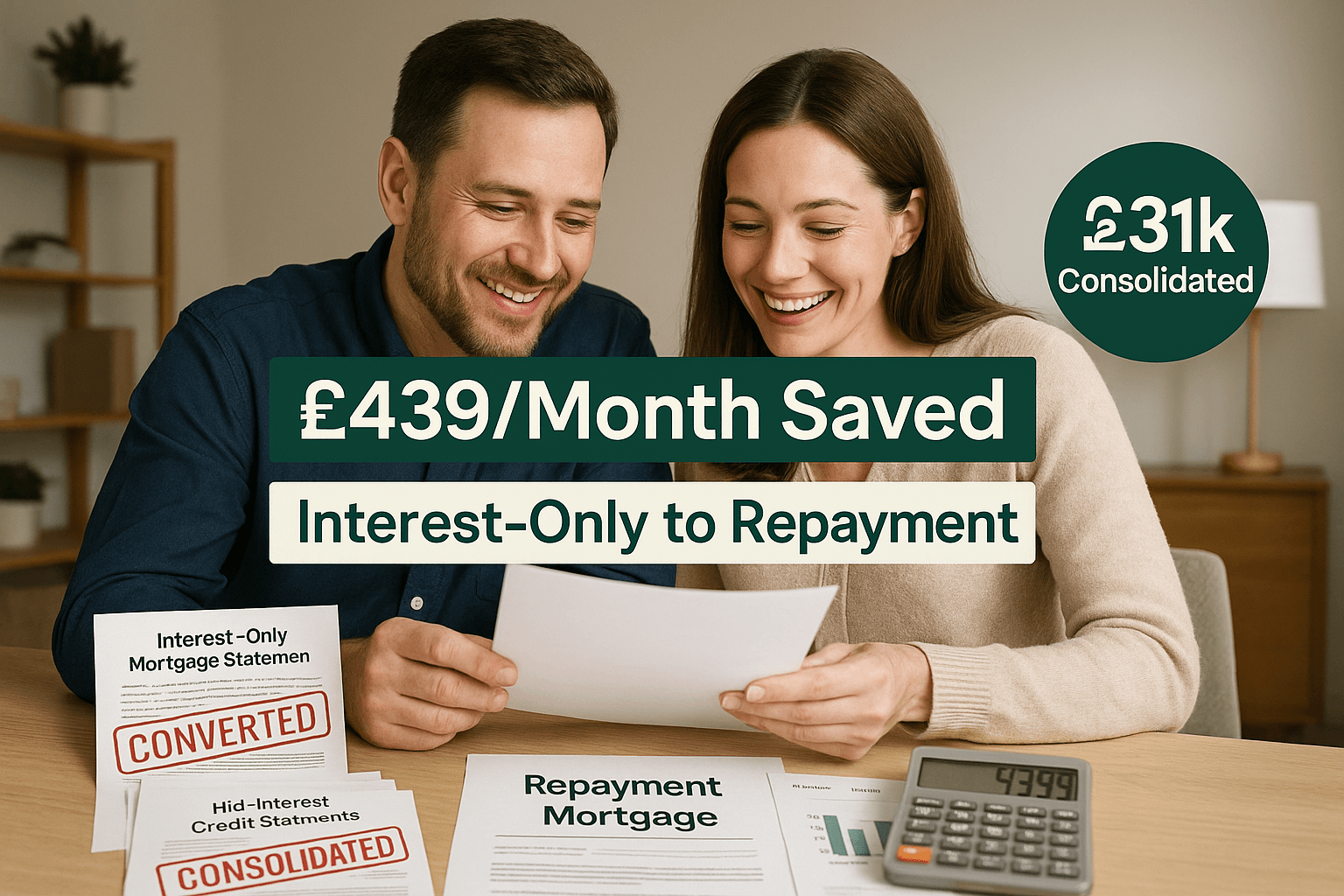

Interest-Only to Repayment: £439/Month Debt Consolidation

Facing growing unsecured debts and the challenges of switching from an...

Accord Mortgages Rate Rises September 2025: Apply by Sept 10

Borrowers considering an application need to be aware of these imminent...

Vida Homeloans: 90% LTV Foreign Nationals & BTL Rate Cuts

Vida Homeloans has announced significant product and criteria...